Why Should I Care if My Vendors Have Insurance?

Your wedding day is a once-in-a-lifetime event, and hiring wedding vendors to bring your day to life is a large part of the planning process. You may have heard or read somewhere to verify your vendors are insured, but it’s easy to assume that your happy, smiling florist, photographer, or baker has insurance. Unfortunately, that’s often not the case. So why should you care if your vendors have insurance? Verifying that your vendors are legit, insured, and tax-paying businesses is a small step to avoid potential catastrophe down the road.

What is a “legit vendor?”

“Legit” itself means “conforming to the rules” or “legal.” This means that your vendor has taken all the appropriate steps to run an ethical business, including—

Registering their business with the state and federal entities, as appropriate. This is commonly done as a limited liability company (LLC), sole proprietorship, corporation, or partnership. This may or may not include a Doing Business As (DBA) statement.

Registering for a seller’s permit and/or tax ID if physical products are changing hands.

Setting up a business bank account to keep personal and business expenses separate.

Purchasing liability insurance, at a minimum. Professional and gear insurance policies are ideal, as well.

Why does this matter to me?

The steps above are very “behind the scenes.” You’d never know if a vendor had done these steps without asking them, and that may feel awkward. But, you have a darn good reason to care. A vendor that takes the time (and headache) to register their business likely isn’t going anywhere. They will likely have a strong contract, consistent communication, and a great deal of skill in their niche. They won’t be “fly by night” vendors who will take your money, ignore your calls, and be a no-show on your wedding day.

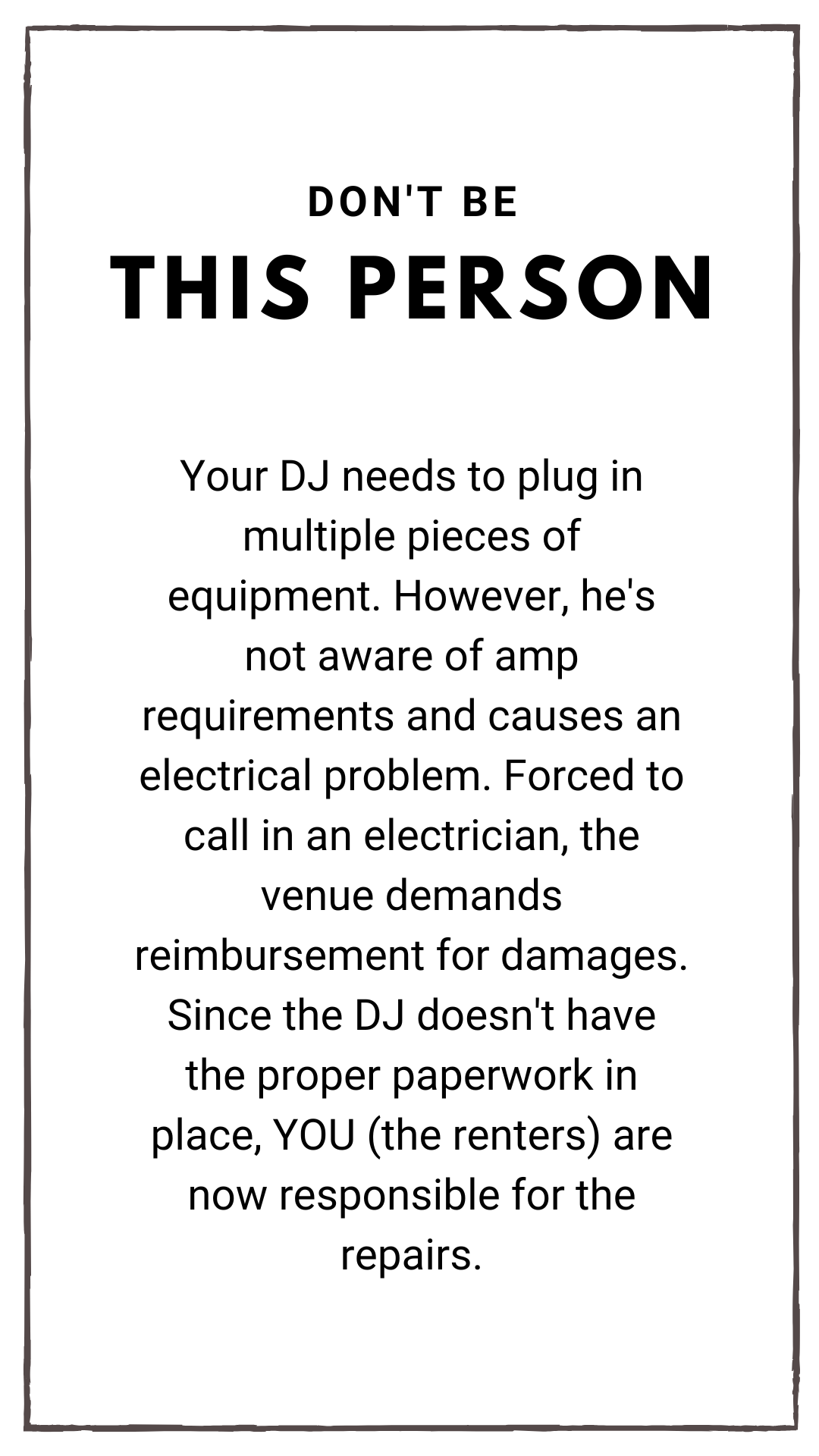

A company’s insurance policy, specifically, protects you from unforeseen incidents and accidents. Here are a few examples of times that your vendors’ insurance (or lack of insurance) could directly affect your wedding day—

You or a guest are injured due to a vendor’s actions (tripping over a cord, falling light stand, etc.). The legally-responsible vendor (owner of the cord, light stand, etc.) has an insurance policy that covers the medical bills.

The photo/ video/ dj has all their gear stolen the week before your wedding. Gear insurance covers rental or replacement so they can recover quickly and be ready for your wedding.

A candle gets knocked over and starts a tablecloth on fire. The decorator’s policy covers physical product damage, damage to the property, or medical bills for the people involved.

A caterer damages the flooring at the venue. The caterer’s insurance pays to replace the flooring.

If these vendors didn’t have appropriate insurance, you would be stuck footing the bill for what happened at your event. Or, you may find yourself scrambling to book a replacement vendor a week before your wedding.

How can I tactfully verify that a vendor is legit?

Generally speaking, because of the sheer amount of liability and investment, venues will carry hefty insurance, as will transportation vendors. These vendors are usually bound by numerous safety and food/ alcohol oversight. They’re typically not the ones to worry about. Home-based businesses are the group that can most easily skate through the legal landscape undetected.

When you’re interviewing prospective venues and vendors, straight up ask them about their insurance policies. Do they have them? If so, what do those policies cover? There are also a handful of documents your vendor can provide to demonstrate legitimacy— a business registration, a certificate of good standing from the state, or a certificate of insurance are a few. These are items a vendor should be able to get if they don’t have them on hand.

Worried about offending a vendor by asking? Don’t be! A legit vendor will be glad you asked, while someone operating without insurance probably isn’t someone you want to hire anyway.

What if I find out a vendor is NOT legit?

The absence of insurance and legit business status may not be a deal-breaker for everyone. But do tread lightly. Not having insurance should be cause for reconsidering the vendor. QC Wed Me encourages all couples to operate under the “better safe than sorry” philosophy, especially on their wedding days.

Ultimately, you’re responsible for everything that happens on your wedding day. Explore your options, talk to professionals, and take the steps you need to protect your wedding day investment and peace of mind.

* Your vendors/ venue providing proof of insurance is not the same as you purchasing wedding insurance. They cover different circumstances and neither is a substitute for the other. For more on wedding insurance policies that you- the couple- may purchase, click here.

** Beginning in 2023, all vendors advertising with QC Wed Me must provide proof of insurance coverage.

We’re excited to be the Quad Cities region’s FIRST all-inclusive wedding blog and vendor directory! We are celebrating all things love in the QCA and helping couples plan their happily ever after!

Dream it. Plan it. Love it.